EJM, College, Leh organises webinar on Mutual fund

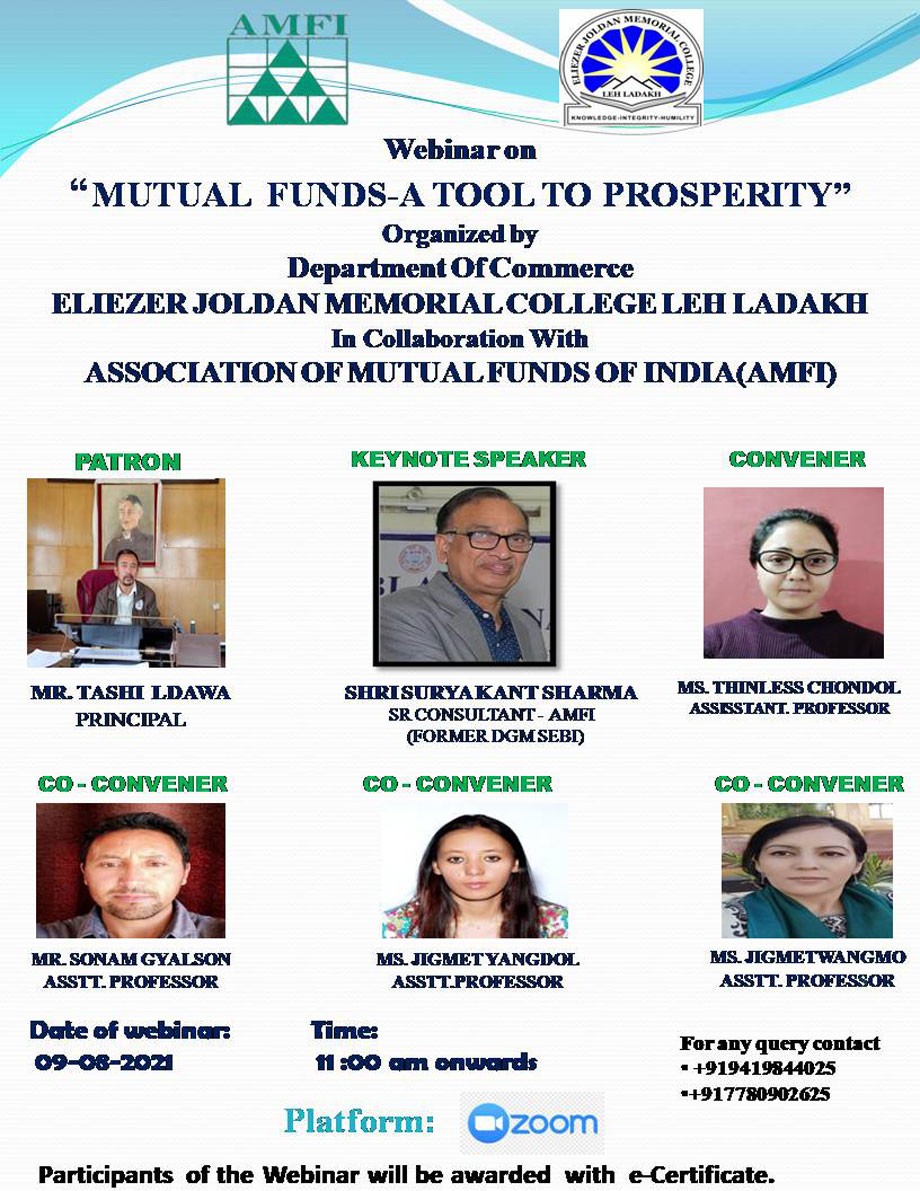

An investor awareness webinar themed, “Mutual Fund-A tool to prosperity” was organised jointly by the Association of Mutual Funds in India (AMFI) and Department of Commerce, Eliezer Joldan Memorial College, Leh on August 9.

More than 300 participants joined the online meeting platform.

Prof. Tashi Ldawa, Principal EJM College, Leh stressed the need for such programmes on financial literacy and suggested the participants consider the advice given by the key speaker regarding the financial security of the individuals and implement it in their personal financial decisions.

Keynote speaker, Surya Kant Sharma, Senior Consultant AMFI spoke about the importance of financial security of individuals. He emphasized that an investor should first think and ensure adequate life insurance, reasonable medical insurance cover, and an emergency fund before embarking upon the journey of wealth creation through sustained investments which are most essential for prosperity. He stressed regular savings and an increase of savings every year minimum by 10%.

Surya Kant Sharma spoke in detail on the need for wealth creation for prosperity and emphasised that investors should not be money accumulators but wealth creators which only would make them comfortable about their money needs for their milestones in life.

The participants were advised to look at the real return and not on notional return as inflation and tax liability substantially takes away a major portion of notional return. Also cautioned that most of the investments except in governmental schemes have a risk which can be managed by a simple formula – Think, understand and invest. He also emphasized the need to have financial planning of their families in place for focused investment and also the need for practicing the rule of compounding in investments for higher return in long run.

Basic information on various investment avenues available in the market viz. Government/RBI bonds, corporate bonds, Government schemes (Post office schemes, PPF, NPS, Sukanya Samriddhi Scheme, securities market etc. real estate, gold, and securities market were shared. All these avenues are different and have distinct features and investors should invest their hard-earned money according to his/her risk apatite and time horizon of investment, Sharma added.

He cautioned general investors not to enter into the securities market directly as there are inherent risks in the market and unless the investor has sound knowledge of market, sectors, economy, international economy etc. Instead, mutual funds are the best option available for general investors wherein he/she can invest a minimum amount of Rs.500/- through Systematic Investment Plan (SIP) and built a good corpus over a while. He also mentioned that in mutual funds there are number of schemes as per risk apatite and time horizon of investors. There is a wide spectrum of mutual funds schemes ranging from equity funds to debt funds to exchange-traded funds which can be chosen by an investor as per his risk apatite and investment horizon.

The participants were also cautioned not to invest their hard-earned money on the advice of others including agents and in unregulated fund mobilisation schemes – Ponzi scheme, chit funds and committees etc. - which give assurance for higher and quick return at the beginning but ultimately vanish with the hard-earned money of investors. He also informed that as per a survey, investors have lost more than ten lakh crores of rupees in such unregulated fund mobilisation schemes.

In the session on National Pension Scheme (NPS), features of NPS were shared by the invited speaker. A question-answer session was made open for the participants.

Thinless Chondol, Assistant Professor of Commerce, EJM College, Leh also the convenor of the webinar moderated the session and encouraged the participants to actively participate. Jigmet Yangdol, Assistant Professor of Commerce, EJM College, Leh also spoke on the occasion.